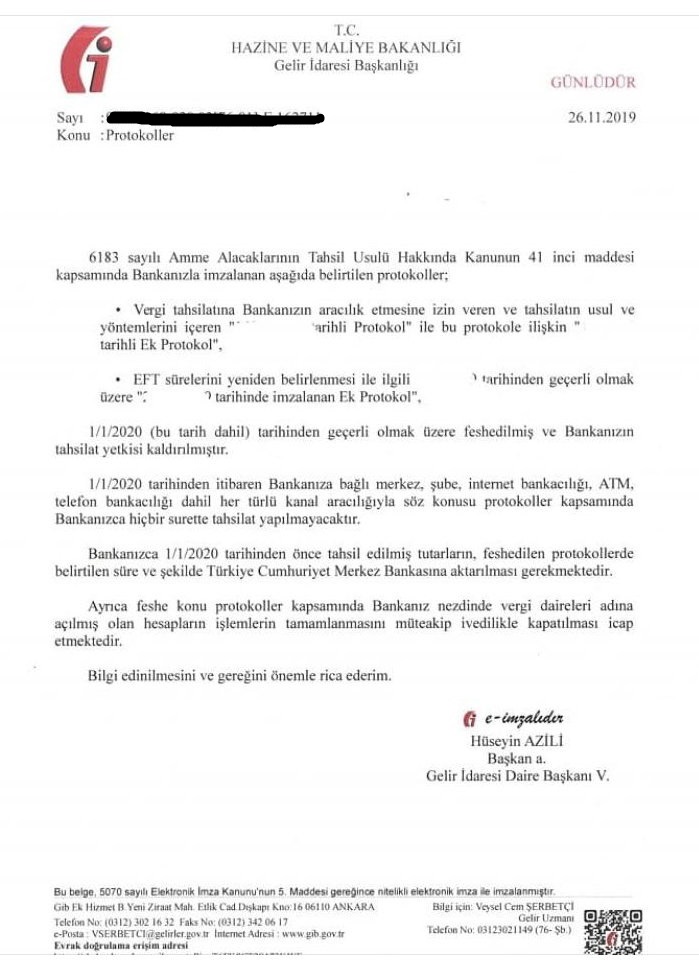

As of January 1, 2020, the Revenue Administration will terminate the tax collection practice through private banks.

In the letter sent to the banks, it was stated that the tax collection practices of private banks through all kinds of channels, including head office, branch, internet banking, ATM and telephone banking, will end as of January 1, 2020. As of this date, taxpayers who are private bank customers will only be able to pay taxes via the GİB's website, with their bank's credit cards.

On the other hand, it is stated that the letter in question did not go to public banks and that public banks were exempted from the said application. In other words, it was learned that public banks will continue to pay their taxes through all channels including individuals and institutions that are customers of these banks, their headquarters, branches, internet banking, ATMs, and telephone banking. In summary, citizens or institutions that want to pay all kinds of taxes will either pay their taxes after January 1 to the Revenue Administration or through public banks.

Post a Comment