| DIGITAL SERVICE TAX |

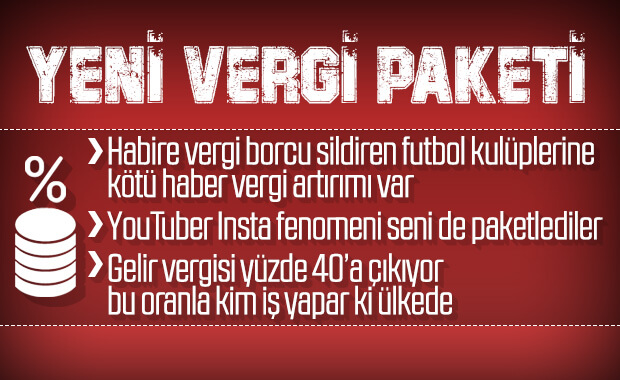

- The services offered in Turkey by digital service providers (advertising services, selling, listening, watching, playing, recording, providing and operating an environment where users can interact with each other, and brokerage services for these services in the digital environment) constitute the subject of this tax.

|

- The taxpayers are those who provide the digital service.

|

- Parties to taxable transactions may be held responsible for the payment of tax for the purpose of securing tax receivables.

|

- Those with a revenue of less than 20 million TL from Turkey or less than 750 million € or equivalent foreign currency equivalent of TL from the world are exempt from this tax.

|

- The tax base is the revenue generated by digital services.

|

|

|

- The tax is found by applying to the base, no deduction is made from the calculated tax.

|

- The taxation period is one-month periods in the calendar year.

|

- The tax is levied upon the declaration.

|

- The tax is levied by the tax office to which it is affiliated in terms of VAT. (To be determined by the Ministry of Treasury and Finance by non-affiliates.)

|

- The paid tax can be deducted as an expense in determining the net income based on income or corporate tax.

|

- Taxpayers who do not fulfill their declaration and payment obligations may be warned, this situation is announced on the website of the GİB. If the obligations are not fulfilled within 30 days from the announcement date, it may be decided to block access until the obligations are fulfilled.

|

| |

| ACCOMMODATION TAX |

- Services offered in accommodation facilities (such as hotels, motels, holiday villages, hostels, apartments, guesthouses and camping etc.) are subject to accommodation tax.

|

- Taxpayers are those who provide these services.

|

- The tax base is the sum of the services and values provided excluding VAT.

|

- The tax rate is %2. (%1 until 31.12.2020)

|

- Accommodation tax is also shown on invoices and similar documents. This tax is not deductible. It is not included in the VAT base.

|

- The taxation period is one-month periods in the calendar year. It is declared until the evening of the 26th day of the month following the taxation period and is paid to the tax office to which it is bound in terms of VAT (to the tax office of the place where the facility is located).

|

| REGULATION IN INCOME TAX SCHEDULE |

- Gelir vergisi tarifesinde yeni bir dilim eklenmiş ve vergi oranı %40 olarak belirlenmiştir.

|

| The proposed tariff is as follows; |

| % 15 up to 18,000 TL |

| 2,700 TL for 18,000 TL of 40,000 TL, plus % 20 |

| 7.100 TL for 40.000 TL of 98.000 TL, (7.100 TL for 40.000 TL of 148,000 TL in wage income), surplus % 27 |

| 22,760 TL for 98.000 TL of 500.000 TL, (36.260 TL for 148,000 TL of 500.000 TL in wage income), surplus % 35 |

| 163,460 TL for 500,000 TL of 500,000 TL (159,460 TL for 500,000 TL of 500,000 TL in wage income), surplus % 40 |

| |

- An annual income tax return will be submitted for the withheld taxed wages, which are received from a single employer and exceed the amount in the 4th income bracket (500.000 TL).

|

- If more than one employer receives taxed wages with withholding, but the sum of the wages received in the next one exceeds in the 2nd income bracket (40,000 TL), these incomes will be declared as before.

|

- While receiving taxed wages with withholding from more than one employer, the sum of the wages received in the next one does not exceed the 2nd income bracket (40,000 TL); However, if the sum of this wage and the wage received from the first employer exceeds the amount in the 4th income bracket (500,000 TL), these incomes will be declared.

|

- Those who earn royalties in excess of the amount in the 4th income bracket (500,000 TL) are required to submit a declaration.

|

| |

| REGULATIONS REGARDING LEASED OR ACQUIRED PASSENGER CARS |

| Except for those whose activities are partly or wholly in the rental or operation of passenger cars in various ways, used for this purpose; |

- Up to 5,500 TL of the monthly rental price for each of the passenger cars acquired through leasing,

|

- Up to a maximum of 115,000 TL of the sum of SCT and VAT on the acquisition of passenger cars,

|

- Maximum % 70 of the expenses related to passenger cars,

|

- The first acquisition price excluding SCT and VAT is 135,000 TL. In cases where the aforementioned taxes are added to the cost value or the passenger car is acquired as second hand, the portion of the depreciation allocated for each of the passenger cars whose depreciable amount exceeds 250,000 TL, which corresponds to these amounts at most. ,

|

| It is foreseen to write an expense. |

- Since these amounts will be increased every year at the revaluation rate, the amount in force at the date of acquisition of the passenger car will be taken into account in determining the depreciation amount.

|

- It is foreseen to make similar changes in Article 68 of the GVK (Income Tax Law) in order to apply the relevant regulation to the expenses of self-employed passenger cars.

|

| VALUABLE HOUSING TAX |

- Residential properties with a value over 5,000,000 TL constitute the subject of the tax.

|

- The tax base is the higher of the building tax value and the value determined by the General Directorate of Land Registry and Cadastre.

|

- Tax rate; It is foreseen as 5.000.000 TL – 7.500.000 TL (3 per thousand), 7.500.001 TL – 10.000.000 TL (6 per thousand), 10.000.001 TL and above (10 per thousand).

|

- The amount is declared to the tax office in the place where the residence is located, until the end of the 20th day of February of the year following the year.

|

- It is assessed and accrued annually, and it is foreseen to be paid in 2 equal installments at the end of February and August.

|

| |

| OTHER FEATURED INVESTIGATIONS |

- BSMV (Banking and Insurance Transactions Tax) rate is less than 1 per thousand 2 per thousandwill be upgraded to .

|

- Public transportation cards, tickets or payment instruments used for this purpose are provided to employees in workplaces where transportation service is not provided, and the amount up to 10 TL per day. transportation fee exceptionwill be considered as overpayment.

|

- In accordance with the Enforcement and Bankruptcy Law and the Attorneyship Law, those who are liable to pay the attorney's fee (including those deposited in the enforcement and bankruptcy directorates) imposed on the other party, and if the payment is made to the lawyer's client, the client is required to withhold income tax.

|

- To tax-compliant taxpayers vergi indirimine ilişkin düzenleme öngörülmüş, beyanname ibaresi maddede sayılan beyannameler ile sınırlandırılmış, tahakkuk ödenen vergilere ait ödeme koşulu da gelir ve kurumlar vergisi beyannamelerinin verilme süresine çekilmiştir. Ayrıca mahsuben ödemelerde daha sonra yapılan tespitlerde mahsuben ödenmek istenen tutarın %10’una kadar yapılan eksik ödemenin indirimden faydalanmaya engel teşkil etmeyeceği öngörülmektedir.

|

- Discount rate for tax loss penalties, regardless of whether it is committed for the first time or not. %50 in accordance with the conditions in the article for the tax loss penalty to be paid in case of reconciliation. %25 rate of discount is foreseen.

|

- The periods of explanation, declaration and payment of those invited to clarification are less than 15 days. to 30 days is removed.

|

- Fees paid to sports referees income tax exemption removal is anticipated.

|

- The article that determines the rate of withholding to be made from the wages made to the athletes and the payments considered as wages. 31.12.2023The withholding rate applied to the wages of the athletes in the top league in sports branches that are in league style. % 20 has been foreseen.

|

Post a Comment